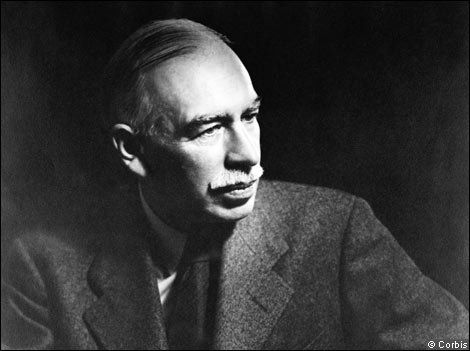

The Arch-Heretic of Twentieth Century Economics: John Maynard Keynes was one of those rare heretics whose ideas worked so well in practice that they became (for thirty extraordinary years) the new orthodoxy. His radical economic thinking inspired everyone from Adolf Hitler to Mickey Savage.

IS IT POSSIBLE to be both a politician and a heretic? With

the times so out of joint it’s a question more and more voters around the world

are asking. Observing the peculiar unanimity with which the international

political class has responded to the global financial crisis, this voter

scepticism appears entirely justified. In only a handful of countries (the most

obvious being Greece) have politicians either voluntarily, or by the sheer

force of public opinion, promoted policies unsanctioned by the global guardians

of economic and political orthodoxy.

This was certainly not the case the last time the world was

mired in economic catastrophe. One of the most intriguing historical aspects of

the Great Depression of the 1930s is the willingness of contemporary political

leaders to challenge the economic orthodoxy of their day.

On the Right, in Germany, Hitler tackled his country’s

massive unemployment and stagnant industry by embarking on a programme of

comprehensive rearmament – what later came to be known as “militarised

Keynesianism”. On the Left, in the Soviet Union, Joseph Stalin’s “Five Year

Plans” mobilised the entire population behind a crash programme of

industrialisation. Somewhere between these two extremes, Franklin D.

Roosevelt’s “New Deal” put hundreds-of-thousands of Americans to work on bold

public infrastructure projects such as the Tennessee Valley Authority and the

Grand Coulee Dam.

Spend, FDR, Spend! The Grand Coulee Dam became one of the enduring symbols of the New Deal's massive investment in US infrastructure. When everyone else is broke, the state is both practically and morally obliged to stimulate the economy out of trouble.

What made these programmes so unorthodox was the way they

were paid for. Herr Doktor Hjalmar Schacht, Hitler’s Minister of Economics,

deployed his infamous “Mefo Bills” to pump-up the German arms industry. This

financial device was somewhat akin to our first Labour government’s use of

“Reserve Bank credit” to fund its state housing programme – only bigger. FDR

was similarly persuaded to pay for his public works schemes by sending the

United States’ budget into the red. By contrast, Stalin’s economic success was

based on the super-exploitation of his own unfortunate people – especially the

unpaid labour of the millions of political prisoners his secret police had

poured into the “gulags” (Soviet concentration camps).

While Stalin followed the brutal methods adopted by Western

capitalists in the early stages of the industrial revolution, and then

throughout the wretched territories of their sprawling colonial empires during

the late-nineteenth and early-twentieth centuries (check out the history of the

“Belgian” Congo for the most gruesome example of pre-Soviet super-exploitation)

both Roosevelt and Hitler were inspired (either directly or indirectly) by the

thinking of the greatest economic heretic of the twentieth century, John

Maynard Keynes.

Defying his orthodox colleagues’ advocacy of austerity

measures to bring their respective governments’ books into balance, Keynes

argued that politicians must counter the “paradox of thrift” by borrowing and

spending their way back to prosperity: “For Government borrowing of one kind or another is nature’s remedy, so to speak,

for preventing business losses from being, in so severe a slump as the present

one, so great as to bring production altogether to a standstill.” His 1933

book, The Means to Prosperity, was

read with great enthusiasm by FDR’s “Brains Trust” of economic advisers. German

economists read it too.

So effective were

Keynes’ heretical ideas at relieving the misery of the Great Depression and

financing the Allies’ victory in World War II that, by 1946, they had become

the new economic orthodoxy. And, if

the proof of his theoretical pudding was in the eating, then the extraordinary

longevity of the post-war boom (1945-1975) provides ample evidence for the

efficacy of Lord Keynes’ economic recipes. Indeed, one could argue that the

concerted (and unfortunately successful) campaign by corporate capitalism’s

intellectual apologists to convince the world that the classical economists’

1930s critique of the Keynesian “heresy” was correct, lies at the root of all

our present evils.

It is tempting to

say that what the world needs is “another Keynes” to lead it out of its present

economic woes. But that would be wrong and foolish. Keynes’ ideas are there on

the bookshelves: just waiting for a politician with the will to use them. Our

world’s predicament lies precisely in the fact that its self-serving and

morally compromised political class is simply too gutless and too heartless to

risk the accusation of heresy.

As Keynes himself

observed, these peddlers of neo-classical orthodoxy “resemble Euclidean geometers in a non-Euclidean world who, discovering

that in experience straight lines apparently parallel often meet, rebuke the

lines for not keeping straight”.

This essay was

originally published in The Otago Daily Times, The Waikato Times, The

Taranaki Daily News, The Timaru

Herald and The Greymouth Star of Friday, 15 June 2012.

10 comments:

The conservatives will do anything to stop a return to genuine Keynesianism, because that means a return to a role for knowledge in economic policymaking that supersedes the whims of individuals. They would rather die than have that. Perhaps we should let them die. ;-)

The other weird thing is this: how small and insignificant our current crop of intellectuals seem when compared to former greats such as Keynes.

I think most of us would agree with Keynes …“The theory of

economics does not furnish a body of settled conclusions immediately

applicable to policy. It is a method rather than a doctrine, an apparatus of

the mind, a technique for thinking, which helps the possessor to draw

correct conclusions…”

http://www.economics.harvard.edu/faculty/mankiw/files/What%20Would%20Keynes%20Have%20Done.pdf

A good piece.

The problem that Keynes recognised as the 'paradox of thrift' is nevertheless still with us.

It's genuinely difficult to convince those practicing private austerity that public austerity might not be the best solution to current woes.toesfo

I would like to thank anonymous at 1.14pm.

I have spent years trying to find a polite way to describe economics and economists(impolite ones are easy).

Economics is descriptive (at best) or conjectural.

It can never be prescriptive. There is no agreed body of tested ideas that could be regarded as facts.

There are many sects and cults of economists who claim to have established facts. Sigh.

As Galbraith said "Keynes was for a time and not for all times". Our times differ markedly from the last great Depression: resources were readily available then. By contrast the resource base we rely upon now is stretched and imminently going to fail to meet demand. Peak oil is a fact, peak everything else close.

Growth is the constant Keynes and every other economist of the past has followed; that prescription is not available longer term. The new heretics will prescribe for decline, they will be both correct and despised for their prescience. We are the spoiled teenagers whose party is about to be shut down.

I studied basic economics a few years ago. The mindset was completely closed, like a neoliberal rat trap. It was obvious that there are a number of weaknesses in economic theory, the main one being that people don't behave in the way that economists assume they do. Any student of psychology should be able to figure that out. I do believe that economists are now beginning to take some notice of psychology. In the equations that neoliberal economists base their theories on are very old, from physics, and according to a physicist friend of mine - rubbish. So a lot of what they say can be consigned to the dustbin which contains ratings agencies :-).

What happened post WWII was largely not what Keynes said. Rather it was a neo-classical rip off of the name and (notably) dropping the uncertainty concept on which his theory depends.

There are several other economists who have written about what we are currently undergoing, economically. A current leading thinker is Steve Keen (interviewed by Kim Hill a few weeks ago). Hiram Minsky took Keynes' general theory and expanded it to explicitly cover all of the capitalist cycle of boom to bust and back again.

Nick

The point you make is not without merit. We don't live in the 1930s and we have challenges that people then did not have to face, just as they had challenges from which we've been mercifully spared.

But Keynes was far from being a dogmatist and didn't create a dogma. Instead, he developed a sophisticated and flexible style of thinking about the economy, that emphasised real world issues instead of the largely theoretical constructs of his predecessors and critics.

Some of our real world problems have changed. But others remain intractably the same. One of these is the periodic failure of demand, leading to slumps that, if unchecked, blight the lives of millions of people.

Effective demand management is no less relevant in a world of scarce resources. Indeed, it may be even more relevant, as boom and bust cycles seem bound to frustrate any attempts to place raw material extraction onto a more sustainable basis.

Keynes was also remarkably prescient about the dangers of massive capital flows and the limits of free trade. Again these are issues that should concern us irrespective of our views on the desirability of growth.

Of course, Keynes didn't live on into the post-war world, when his thinking became an ideological default and was, inevitably, bowlderised in the process.

Had he lived longer, he might, I suspect, have demurred from the managerialist religion of growth that took over in those years. He was, after all, a Burkean conservative (albeit a member of the Liberal Party), an aesthete and a Bloomsburyite.

Victor, I don't disagree with anything you say, Keynes was as you say never a dogmatist. And neither were Schummacher, Minsky and now Keen. Unfortunately all of these minds are being blindsided by the overwhelming dogma that is inherent in the "economics" profession. Keynes would recognize this I suspect and smile knowingly.

Your comment about demand management is the enigma at the core of declining resources. It really means that none of the prescriptions, Keynesian or otherwise can produce the income or growth required currently to prop up our debt mountain.

Watch that space over the next decade as declining resources challenge demand.

Nick

Thanks for your response.

To my mind, if Keynesianism remains relevant, it must be on the understanding that counter-cyclical stimulus be matched by counter-cyclical austerity (and regulation)when the business cycle returns to health.

This approach would not, of course, be sufficient to address the decline in resources. And it fails to take account of the possibility that the current slump is the start of a permanently denuded future, from which there will be no recovery, however temporary.

So I will keep watching that space but I'll also keep thinking in basically undogmatic Keynesian terms until something better turns up or until a credible synthesis emerges.

Meanwhile, I note with interest that Keynes's biographer and panagyrist, Robert Skidelsky, has just co-authored a work entitled "How Much is Enough?"

Post a Comment